How much does bookkeeping cost?

How much does bookkeeping cost?

It’s one of the most common questions we hear from small business owners in Edmonds, Lynnwood, Shoreline, Mill Creek, and Snohomish. If you’re running a service-based business maybe you’re a contractor, remodeler, or designer - you already know bookkeeping isn’t optional. You need clear numbers to manage cash flow, make smart decisions, and stay tax compliant.

But the cost of bookkeeping? That’s where things get confusing. Google it and you’ll see answers ranging from $99/month to several thousand dollars. No wonder so many business owners are left scratching their heads.

The truth: bookkeeping isn’t one-size-fits-all. Costs vary depending on your business, your complexity, and what level of support you need.

This blog will help you:

Understand what factors drive bookkeeping pricing.

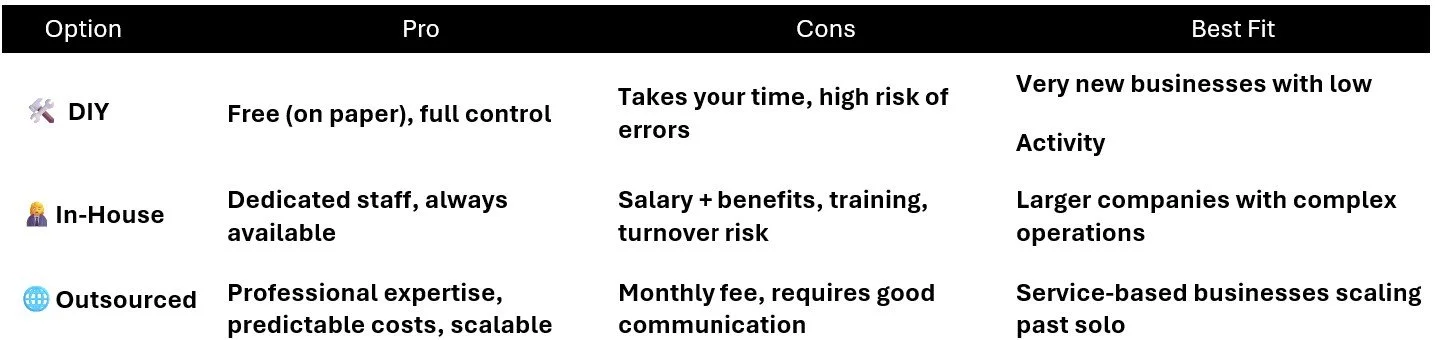

Compare the main options (DIY, in-house, outsourced).

Get clarity on what to expect as a service business in the Edmonds area.

👉 Want the full breakdown, with real examples?

Why You Won’t Find a One-Size-Fits-All Answer

Bookkeeping isn’t like buying a flat of shingles or a gallon of paint. It’s a tailored service.

Here are the big factors that drive costs:

Number of transactions. A business with 50 transactions/month takes far less time than one with 500.

Accounts and credit cards. One bank account is simple. Add three checking accounts and two credit cards, and things get more complex.

Employees. Even one employee adds payroll entries, reimbursements, and compliance requirements.

Loans and assets. Trucks, equipment, and office leases must be tracked and depreciated properly.

Complexity of operations. A designer billing a few clients a month has different needs than a general contractor running multiple crews and managing loan payments.

👉 Many bookkeeping firms hide these factors behind a “starting at” price. That’s how $99/month turns into $800 once all the add-ons kick in.

At Plumb Financial, we’ve built our pricing differently: flat monthly rates that scale with your business, so you know what to expect.

📘 Want a transparent look at what really drives bookkeeping costs?

The Cost of DIY Bookkeeping

DIY seems cheap until you factor in what it really costs.

Hidden costs of DIY bookkeeping:

Time. Every hour you spend in QuickBooks is an hour you’re not running projects, finding new clients, or managing your crew.

Errors. Missed deductions, uncategorized expenses, and mistakes that can draw IRS attention.

Stress. Wondering if your numbers are right or if your tax bill will catch you by surprise.

📍 Example: A remodeler in Lynnwood once told me he spent Sunday nights trying to reconcile accounts after a full week of field work. He thought he was saving money until his CPA charged extra at tax time to fix the mess.

👉 Curious what you’re missing by staying DIY?

Hiring a Part-Time or In-House Bookkeeper

Some businesses look at bringing a bookkeeper in-house.

Pros:

Someone dedicated to your company.

You have someone embedded in your business.

Cons:

Cost. In the Seattle area, even part-time bookkeepers often cost $30–$40/hour, plus payroll taxes and benefits. Full-time? You’re looking at $50,000+ annually.

Management. Training and oversight still fall on your shoulders.

Turnover risk. If they leave, you’re starting from scratch.

For many service-based businesses in Edmonds, Mill Creek, or Snohomish, in-house bookkeeping is more overhead than it’s worth.

👉 Wondering if in-house makes sense for your business?

Outsourced Professional Bookkeeping: The Middle Path

Outsourced bookkeeping combines professional expertise with predictable pricing.

How it works:

You pay a flat monthly fee.

Your bookkeeper reconciles accounts, keeps reports accurate, and ensures your books are tax-ready.

You get expertise without the overhead of an employee.

At Plumb Financial, we focus on contractors, remodelers, and service providers in Edmonds, Shoreline, Lynnwood, Mill Creek, and Snohomish. We know the quirks of your industry things like managing job deposits, equipment loans, and seasonality.

And unlike hourly billing (where the more they work, the more you pay), flat monthly pricing builds trust. It encourages communication and collaboration without you worrying about the clock.

👉 Want to see how outsourced bookkeeping fits businesses like yours?

Comparison: DIY vs In-House vs Outsourced

Here’s a quick snapshot of how the three main options stack up:

👉 This is why so many local contractors and service providers in Edmonds and Snohomish land on outsourced bookkeeping as the right balance.

Local Focus: Bookkeeping Costs in the Edmonds Area

Bookkeeping prices vary nationally, but local markets matter too.

In the Edmonds area — including Lynnwood, Shoreline, Mill Creek, and Snohomish — service-based businesses often face these realities:

DIY is common early on, but most owners move on once transactions pile up.

In-house bookkeepers are expensive, especially with Seattle-area wages and benefits.

Outsourcing is growing, because it provides expertise without overhead.

When you’re operating within 10 miles of Edmonds, chances are you’re competing in busy local markets. That means your time is better spent running your business — not reconciling bank feeds.

What Impacts Costs the Most (In Practice)

Let’s take two examples from real life:

Designer Operator (solo, hiring her first employee). One bank account, a couple of credit cards, minimal assets. Her bookkeeping is simple — the priority is tracking expenses and managing cash flow.

General Contractor (5 employees, 4 trucks, office). Multiple loans, equipment financing, office rent, payroll entries, and more. His bookkeeping is complex, requiring detailed reporting and oversight.

The difference in cost between these two businesses is dramatic — and it highlights why flat pricing is about value, not arbitrary numbers.

FAQ: Common Bookkeeping Questions

1. What’s included in bookkeeping services?

Typically: reconciliations, reporting, cleanup/catch-up, advisory, and tax-ready books. Some firms offer payroll, but at Plumb Financial we help with setup (like Gusto) and let you run it.

2. Can I just use QuickBooks myself?

You can but QuickBooks is a tool, not a solution. Without expertise, it’s easy to misclassify expenses, miss deductions, and end up paying more at tax time.

3. How much does bookkeeping cost in Washington state?

Most small service businesses spend anywhere from several hundred to a few thousand dollars a month depending on complexity. In Edmonds and nearby areas, our clients typically invest in predictable monthly pricing that grows with their business.

Conclusion

So, how much does bookkeeping cost?

It depends on your business your size, your structure, and your complexity. But one thing is clear: bookkeeping isn’t an expense to dread. It’s an investment in clarity, confidence, and growth.

Whether you’re a solo designer in Shoreline or a general contractor in Snohomish, you deserve bookkeeping that gives you peace of mind.

👉 Stop guessing. [Download our free Bookkeeping Cost Guide today] — it’s designed to help you budget with confidence.